What is Picket?

An open platform & marketplace to buy, sell, and manage real estate investments and services.

Investor Login For Service ProsExplore the key factors shaping the Texas housing market in September 2024, including mortgage rates, inflation, inventory, and demographic shifts, providing opportunities and challenges.

As of September 27, 2024, the Texas housing market stands at a critical juncture. After years of vigorous expansion, the market is experiencing transformative changes influenced by decreasing mortgage rates, mixed economic indicators, and shifting government policy. This article provides an analysis of the current state of the Texas housing market, examining the interplay of key factors such as mortgage rate trends, inflation dynamics, Federal Reserve actions, housing inventory changes, employment patterns, and demographic shifts. By dissecting these elements, we aim to offer a nuanced perspective on why Texas's housing market is positioned for both opportunities and challenges over the next 12-18 months.

The Texas housing market has long been a bellwether for broader economic trends in the United States, reflecting the intricate balance between supply and demand, economic policy, and demographic movements. In recent years, the state has witnessed unprecedented growth, fueled by robust job creation, corporate relocations, and an influx of new residents seeking affordability and opportunity. However, as we progress through 2024, signs indicate that the market is entering a new phase—one that demands careful analysis and strategic foresight.

Average days on market in Dallas up substantially since last year

Source: Picket Research

Over the past year, the 30-year fixed mortgage rate has declined to an average of 6.26%, a significant drop from the previous year's highs. This decrease has rekindled interest among potential homebuyers who were previously deterred by escalating borrowing costs. Lower mortgage rates enhance affordability, effectively broadening the pool of eligible buyers and stimulating demand.

On the flip side while declining rates boost demand, they also carry the risk of overheating the market. Increased buying power can lead to competitive bidding, driving prices upward and potentially negating the affordability gains from lower rates. Stakeholders must monitor this dynamic to prevent unsustainable price inflation.

Finally, the rapid rise in interest rates from 2022-2023 created a home owner lock-in effect that resulted in historically low listings across the country. It is possible that a decline in interest rates results in a rapid relase of pent up supply, which may partially or entirely offset increases in demand.

The Personal Consumption Expenditures (PCE) index has shown a marked deceleration, reaching an annualized rate of 2.2%. This slowdown alleviates pressure on household budgets, potentially increasing disposable income and consumer spending, which can positively impact the housing market.

However, some economists caution that underlying inflationary pressures, such as wage growth and commodity prices, may resurface. A resurgence of inflation could prompt the Federal Reserve to adjust monetary policies, potentially leading to higher borrowing costs and dampening housing demand.

In light of improving inflation metrics, the Federal Reserve has implemented a 50 basis point reduction in the federal funds rate. This move aims to sustain economic growth by lowering borrowing costs for consumers and businesses alike.

The trajectory of future Federal Reserve actions remains uncertain. While current policies favor economic expansion, unexpected shifts in global markets or domestic economic indicators could necessitate a policy reversal, introducing volatility into the housing market.

Major metropolitan areas in Texas have experienced a substantial increase in housing inventory. The Dallas-Fort Worth (DFW) region, for example, has seen active listings surge by 52% year-over-year. This influx provides buyers with more options and reduces the intensity of competition.

Active Listing Trends

Source: Picket Research

An increased inventory suggests a move towards a more balanced market, alleviating the extreme seller's market conditions of previous years. However, if the supply continues to outpace demand, there is a risk of excess inventory, which could lead to price stagnation or declines.

Texas's economy continues to benefit from job growth in vital sectors such as technology, healthcare, and energy. The DFW area alone has added over 150,000 jobs, bolstering housing demand, particularly in higher-income brackets.

Conversely, employer hiring plans have reached their lowest levels since 2005. This slowdown could signal caution among businesses, potentially affecting future job growth and housing demand. It is essential to analyze whether this trend is a short-term response to economic uncertainties or indicative of a longer-term shift.

Texas remains a top destination for individuals and businesses relocating from higher-cost states like California and New York. The combination of relatively affordable housing, lower taxes, and a favorable business climate continues to attract new residents.

This ongoing population growth supports sustained housing demand, particularly in suburban and urban areas with robust amenities and infrastructure. However, it also places pressure on local resources and necessitates careful urban planning to maintain quality of life.

Certain markets, particularly those that experienced rapid price escalations, are seeing modest price reductions. These corrections are part of a natural market recalibration rather than indicators of a downturn.

List Prices Trends

Source: Picket Research

Analysts from the Texas Real Estate Research Center project that home prices will stabilize by mid-2025. This stabilization is expected to result from the interplay of balanced supply and demand, tempered by cautious optimism among buyers and sellers.

Texas's housing market trends align with national patterns of increasing inventory and moderated price growth. However, the state's strong economic fundamentals and demographic advantages position it more favorably than some other regions.

Despite local strengths, Texas is not immune to national economic challenges such as potential recessions, interest rate fluctuations, or shifts in federal housing policies. Vigilance is required to navigate these external risks effectively.

Policy decisions at the local and state levels can significantly impact the housing market. Initiatives to streamline permitting processes, invest in infrastructure, and promote affordable housing can enhance market stability and accessibility.

Promoting sustainable and equitable development practices ensures that growth benefits a broad spectrum of residents. This includes investing in public transportation, green spaces, and community services.

The Texas housing market of September 2024 is characterized by both opportunities and challenges. Declining mortgage rates and easing inflation create favorable conditions for buyers, while increased inventory levels contribute to a more balanced market. However, potential risks such as employment uncertainties and external economic factors necessitate a cautious approach.

Stakeholders—including policymakers, developers, investors, and consumers—must engage in strategic planning to capitalize on positive trends while mitigating risks. By fostering a resilient and adaptable housing market, Texas can continue to thrive economically and maintain its appeal as a destination for individuals and businesses alike.

Introduction Toilets may not be the most glamorous of household fixtures, but they represent a fascinating intersection of engineering, physics, and design. From the ancient Roman latrines to today's high-tech smart toilets, these essential devices have evolved significantly over the centuries. This guide aims to unravel the mechanics

Dripping Faucets A dripping faucet is more than just a minor nuisance—it could be costing you an unnecessary spike in your water bill. The culprit is often a worn-out washer or O-ring, which tends to occur in older faucets. Steps to Fix: 1. Turn off the water supply beneath

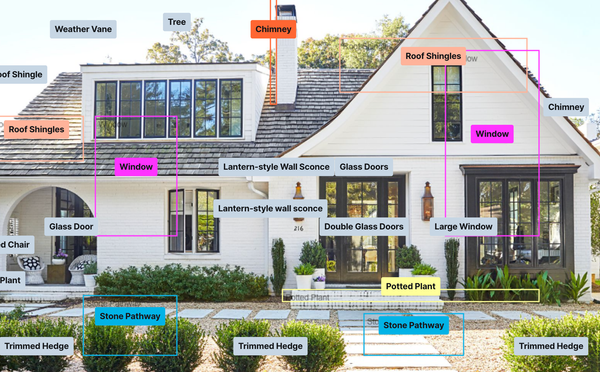

Discover how Picket's advanced AI technology interprets images with remarkable accuracy. From identifying foundation cracks to damaged roof shingles, explore the power of AI image recognition and its revolutionary potential for real estate investment platforms.

Discover why demand-focused housing policies like homebuyer credits or mortgage subsidies often backfire, worsening affordability. Learn about supply-side solutions that can alleviate the housing crisis.

We are committed to providing digital accessibility for individuals with disabilities. If you would like to report an issue or request an accommodation, please let us know.

Picket Realty Services, LLC, holds brokerage licenses in multiple states.

© 2024 Picket Homes. All Rights Reserved