How to Start a Real Estate Investment Company: A Step-by-Step Guide

Learn how to start a successful real estate investment company, from forming your business plan and securing funding to navigating legal requirements and market strategies. This guide provides expert tips to help you build a strong foundation and achieve success in the real estate market.

Introduction: Why Start a Real Estate Investment Company?

Real estate offers a unique opportunity for wealth creation, with its long-term appreciation, cash flow potential, and ability to diversify investments. Unlike stocks or bonds, real estate investments provide tangible assets that grow in value while offering more control over decision-making. Starting a real estate investment company allows you to scale and manage your portfolio, giving you the entrepreneurial freedom to shape your success.

Step 1: Define Your Investment Strategy

Before you begin, it’s essential to define your investment strategy. Are you focused on residential or commercial real estate? Are you planning to flip properties for quick profits or hold them for long-term rental income? Understanding your target market and financial goals will help sharpen your focus and guide your business decisions.

Check out the complete guide below how to think about and define your strategy.

Step 2: Create a Business Plan

A business plan is your roadmap to success. It should include:

- Vision and Mission: Define the purpose of your company.

- Market Analysis: Research your local market and competition.

- Financial Projections: Estimate ROI and outline how you’ll raise capital.

- Exit Strategy: Plan for how you’ll scale, sell, or exit the business.

A well-thought-out business plan is vital not just for your guidance but also for securing partners or investors. Check out our full guide below to creating a comprehensive business plan.

Step 3: Set Up Your Legal Structure

The right legal structure protects your personal assets and optimizes tax benefits. Most real estate investment companies opt for an LLC due to its liability protection and pass-through taxation. However, depending on your needs, you may want to consider other structures like partnerships or S-corps. Don’t forget to ensure your business complies with local real estate licensing and legal regulations.

Check out our full guide below on choosing the right legal structure for new real estate investment companies.

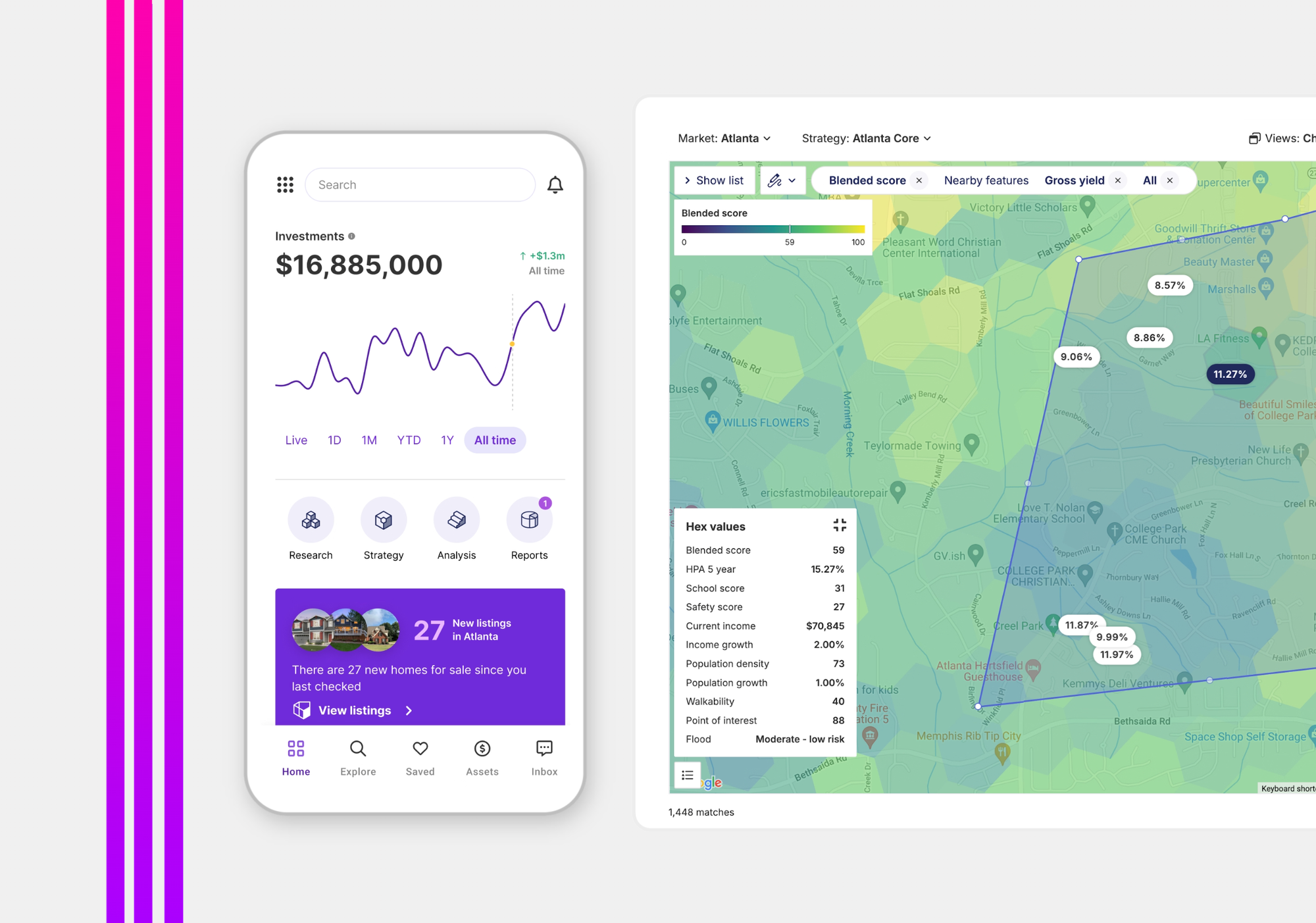

Step 4: Choosing the Right Technology

Choosing the right technology from the start is crucial for building an efficient and scalable real estate investment business. Consider these tools:

- Research & Data Tools: Platforms like Redfin or Picket help you assess market trends and analyze properties.

- CRM Systems: Real estate-specific CRMs simplify managing clients, listings, and transactions.

- Investment Management Software: Track performance, manage cash flow, and scale your portfolio with AI-powered tools.

By leveraging technology, you’ll automate tasks, streamline decision-making, and create a strong foundation for growth.

Step 5: Secure Financing

Real estate is capital-intensive, so securing the right financing is a must. Explore different funding options:

- Personal Savings: A straightforward but limited option.

- Traditional Mortgages: Ideal for long-term rentals or primary residences.

- Private and Hard Money Loans: Often used for property flipping.

- Crowdfunding: A growing trend that allows multiple investors to pool resources.

If your investment strategy involves residential real estate, a lending partner such as CoreVest that already understands the asset class and risk profile can make this process much easier.

Step 6: Build a Strong Network

Real estate investing is a relationship-driven business. Building a network of trusted professionals can open doors and create opportunities. Key players include:

- Real Estate Agents: Experts who can help find great deals.

- Lenders and Financial Advisors: Essential for securing financing and structuring deals.

- Contractors and Property Managers: Critical for property maintenance and renovation.

Additionally, joining real estate investment groups and finding a mentor can provide valuable insights and guidance as you grow your business.

The Open Real Estate Company

Picket is on a mission to make real estate open, efficient, and fun for all

See How It's GoingStep 7: Start Acquiring Properties

Once your company is legally established, funded, and networked, it’s time to start acquiring properties. Begin with:

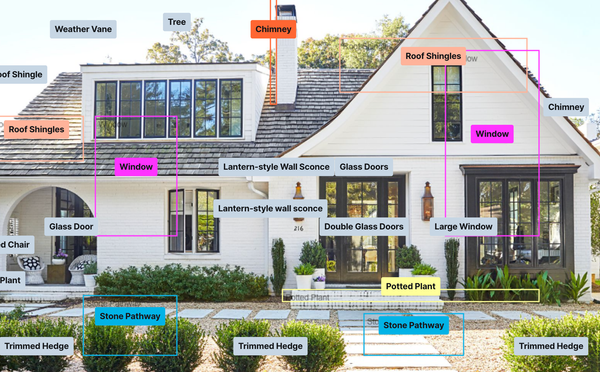

- Property Research: Use data tools to analyze potential cash flow, ROI, and market conditions.

- Due Diligence: Conduct thorough inspections and title checks to avoid pitfalls.

- First Acquisition: Start with a manageable property that aligns with your strategy—whether it's a rental or a flip.

This first property will be your learning experience, helping you refine your process for future investments.

Picket is Built to Scale

From buying your first house to your 1,000th, Picket delivers simple, powerful, and beautiful products to help you succeed.

See for YourselfStep 8: Scale and Diversify

After successfully managing a few properties, focus on scaling your portfolio. Look for ways to diversify your investments by:

- Expanding into different types of properties (e.g., multifamily, commercial).

- Exploring new geographic markets.

- Leveraging property management software to automate tasks and streamline operations.

Scaling successfully requires efficiency and strategic growth, making technology and strong relationships even more important.

Conclusion: Building a Sustainable Real Estate Investment Business

Starting a real estate investment company is both a challenge and a rewarding journey. With the right strategy, business plan, and technology, you can build a sustainable business that grows alongside market opportunities. Keep learning, adapting, and leveraging the tools and resources available to ensure your long-term success.