Small Markets are Big Investment Opportunities

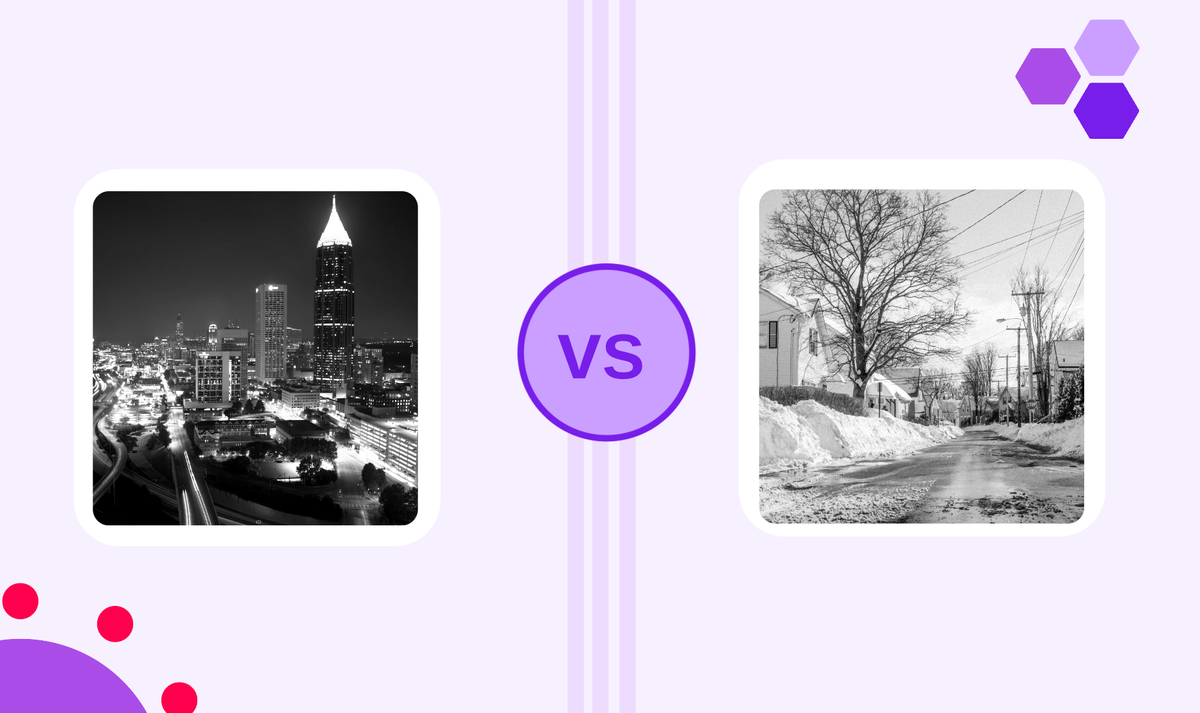

Large markets often seem like the best place to invest in residential real estate, but as these markets become increasingly more saturated, investors are missing lucrative opportunities in small and secondary markets.

Why Small Markets Still Matter

When it comes to residential real estate investing, large markets often steal the spotlight. Cities like Atlanta, Dallas, and Phoenix are seen as prime destinations for investors due to their size, growth potential, and liquidity. For many, these markets seem like the most reliable places to achieve strong returns.

But here’s the truth: large markets are becoming increasingly competitive with large investors all flocking to the same cities from 2010 to 2022. Meanwhile, investors are missing out on incredible opportunities in small and secondary markets, which still offer significant potential for strong returns — and often with far less competition.

Remember only 10% of the U.S population lives in the top 20 largest cities. That means 90% of the residential real estate market is in smaller cities, towns, and rural areas.

Make Small Market Investing Easier

Invest in small markets using the most advanced technology in real estate

See How It's GoingSmall Markets are Misunderstood

There’s a common misconception that investors that smaller markets are too niche or low-volume to be viable for investors. This belief has traditionally been driven by the idea that to make an investment work, particularly at scale, you need access to a high volume of properties. Historically, this led many investors — from large institutions to individual buyers — to concentrate on the biggest, busiest markets.

While scale and liquidity are important, advancements in technology and data science are making it easier for investors of all sizes to identify, acquire, and manage properties in smaller markets. This shift allows both large and small investors to compete effectively in markets that were once thought to be too limited in opportunity.

Why Should Investors Look to Smaller Markets?

Whether you're an institutional an individual investor looking small markets offer a wealth of opportunities:

Less Competition, Better Deals

Larger markets attract a flood of investors, resulting in higher prices and tougher competition. In small markets there is often less competition, which means properties can be acquired at more attractive prices. For smaller investors, this can lead to higher returns without the intense bidding wars often seen in big cities.

Higher Yields and Attractive Cap Rates

While large markets are known for growth, smaller markets frequently offer higher cap rates and better cash flow potential. Investors focused on income generation may find these markets far more rewarding, with rental yields that exceed those available in larger metros.

Untapped Growth Potential

Small and secondary markets often fly under the radar because they don’t generate the same flashy headlines as major cities. However, many of these markets are on the verge of significant growth, driven by factors like population shifts, regional economic expansion, and lifestyle changes. This means they offer the chance to get in early before the market fully appreciates in value. Other smaller markets have unique characteristics that make them highly stable, such as state capitals. Governments spend money in all economic environments so places with high levels of government funded employment can make great markets for investing in real estate.

Choose Markets With Confidence

Picket's research tool gives you real time across markets and submarkets

Explore Market DataTechnology Unlocks New Opportunities

In the past, investing in small markets was logistically challenging. Managing scattered properties over large geographic areas seemed daunting, particularly for smaller investors without the infrastructure to do so efficiently. Today, technology makes it easier than ever to manage properties across multiple markets.

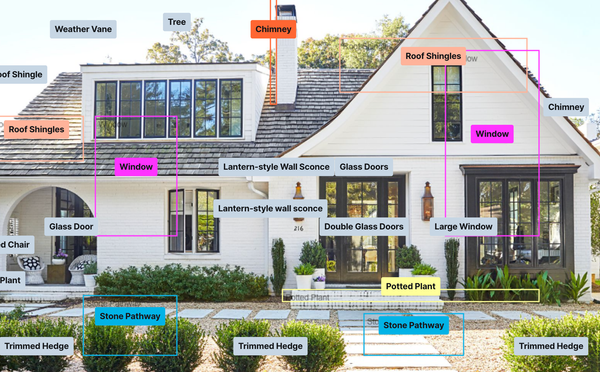

Platforms like Picket offer data-driven insights and management tools that empower investors — large and small — to confidently invest in small markets. From sophisticated geospatial data to property-level analysis, these tools allow you to uncover and manage opportunities in smaller cities with the same precision once reserved for institutional players.

How Picket Empowers Investors in Small Markets

At Picket, we believe that real estate investors of all sizes can benefit from a data-driven, bottom-up approach. Our platform is designed to support everyone, from individual investors seeking to build a modest portfolio to large institutions deploying significant capital. We focus on house-level data, hyper-local market trends, and cutting-edge technology to help you identify hidden opportunities in markets others might overlook.

By leveraging our tools, you can expand into smaller markets confidently, knowing that you’re basing your decisions on the best available data. This allows you to compete effectively — whether you’re investing in one property or hundreds — and capitalize on the unique advantages that small markets offer.

Conclusion: Small Markets, Big Opportunities

The idea that only large markets are worth your time and money is a myth. In fact, some of the most lucrative opportunities lie in the smaller, less competitive markets that others ignore. Whether you're a large institutional investor or just starting to grow your portfolio, small and secondary markets can offer higher yields, less competition, and more flexibility than you might expect.

At Picket, we’re here to help you navigate these markets with confidence. Our platform empowers investors of all sizes to unlock the full potential of their real estate investments.

Picket Is an Open Real Estate Platform

We are on a mission to make real estate open, efficient, and fun for all

Try Platform