Real Estate vs. Stock Market: What Is the Smarter Place to Invest?

Compare real estate and stock market investments, focusing on leverage, volatility, and returns. Discover why real estate often offers a more stable and profitable alternative, and learn how to balance risk with smart investment strategies.

Every day, over $1 billion pours into the stock market from retail investors. Yet, only a small fraction of those investors own residential real estate as part of their portfolio. Here's the kicker: over a 10-year horizon, real estate often outperforms the stock market—and sometimes by a wide margin.

So why does real estate seem to have the upper hand?

Superpowers for Real Estate

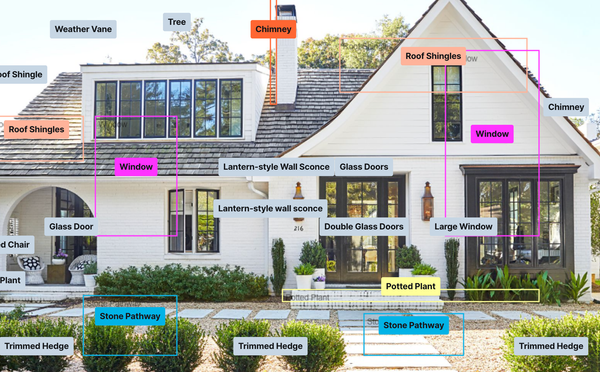

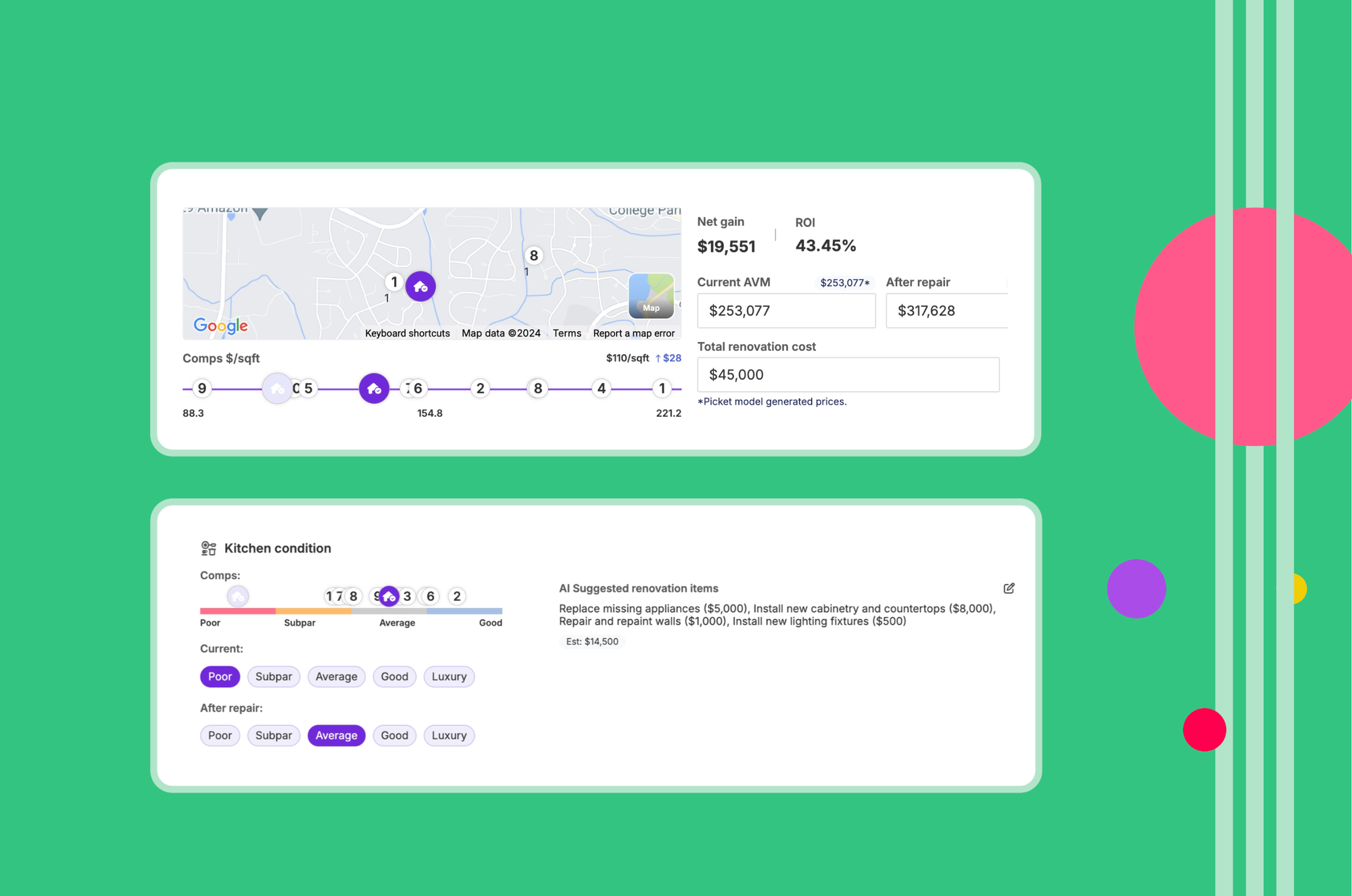

See how Picket helps real estate investors leverage the power of AI

View ProductThe Real Reason Real Estate Shines: Leverage

At first glance, comparing real estate to stocks may seem unfair. The truth is, real estate tends to look better on paper because of one key factor: leverage.

Leverage acts as an amplifier. When property values go up, they increase faster thanks to leverage. But when the market goes down, leverage also magnifies losses. So, understanding how leverage works is crucial for any real estate investor.

Let’s break it down with a simple example.

Case Study: Rental Property Returns

Imagine you own a rental property that earns just enough each year to cover its expenses and interest—meaning your annual return relies solely on the property’s appreciation.

Historically, home prices grow at about 3.7% annually. If you buy a $100,000 property with a 20% down payment ($20,000), over 10 years, you could expect:

| Year | Home Value | Borrowed Amount | Cashflow | Equity Growth |

|---|---|---|---|---|

| 1 | $100,000 | $80,000 | -$20,000 | $3,700 |

| 5 | $115,642 | $80,000 | $0 | $15,642 |

| 10 | $143,809 | $80,000 | $63,809 | 12.3% Annualized Return |

Even without factoring in rental income, real estate gives you an annual return of 12.3%, outpacing the stock market’s historical average of 10%.

But there’s more to this story.

Stock Market Leverage: Why It's a Different Game

Here’s where many people make a mistake: comparing real estate’s leveraged returns to stocks without factoring in leverage for stocks.

If we added the same 80% leverage to a stock market investment with a 10% nominal return, your annualized return could soar to 24.5%. That sounds amazing, right? But there’s a catch—volatility.

Most investors can’t borrow that kind of money to buy stocks. Lenders often cap stock market leverage at 50%. Plus, the volatility in stocks is much higher, and with high volatility comes the risk of catastrophic losses.

Volatility: The Stock Market’s Wild Card

To understand why leverage in stocks is so risky, think of the Martingale betting strategy. It’s a system where you double your bet after each loss, assuming that eventually, you’ll win and recover everything.

Sounds foolproof—until you hit a long losing streak. Suddenly, your losses are snowballing, and the risk of going bankrupt outweighs any potential gains.

Leverage in the stock market works similarly. Yes, it can boost your returns, but it also amplifies volatility to dangerous levels. And when your investment loses value quickly, you might face a margin call, forcing you to sell at a loss.

Why Real Estate is More Stable

Real estate, on the other hand, doesn’t experience the same gut-wrenching volatility. That’s because residential real estate is a necessity—people need a roof over their heads, no matter the economic climate.

Demand for housing is relatively stable, even during economic downturns. Housing prices tend to adjust gradually over quarters or years, while stock prices can plummet in a matter of days.

The housing market’s lower volatility makes it safer to use leverage without worrying about losing your shirt in a matter of hours. Even during the worst housing crisis, price fluctuations were moderate compared to stock market crashes.

The Open Real Estate Company

Picket is on a mission to make real estate open, efficient, and fun for all

See How It's GoingHow Much Leverage is Too Much?

While leverage boosts returns, it also increases risk. The key is to find the sweet spot—where the risk of bankruptcy during downturns is minimal, but the potential for long-term gains remains high.

In real estate, unlike stocks, your home itself serves as collateral for the loan, reducing the risk of collateral calls (or margin calls). You’re not going to get a call from the bank demanding more money during a short-term downturn, which is a common scenario for stock investors using margin accounts.

Let’s take a look at what happens in the stock market when volatility strikes.

Example: S&P 500’s 2015 Crash

In August 2015, the S&P 500 dropped 11% over just a few days, triggered by fears of a Chinese economic slowdown. If you were invested with 80% leverage, you’d be looking at a serious problem. You’d have to come up with additional cash immediately or risk losing everything. In this scenario, selling your stock would lock in a -45% return.

This is why most financial advisors warn against using leverage in stocks. A few crazy days in the market could wipe out your entire portfolio.

To Be Continued…

In the next section, we’ll dive deeper into how much leverage is too much for real estate and how to balance risk with reward. Stay tuned as we explore the fine line between boom and bust when it comes to real estate investing.To be continued.....

Use Picket to analyze millions of properties... instantly