Why Demand-Focused Housing Policies Backfire on Affordability

Discover why demand-focused housing policies like homebuyer credits or mortgage subsidies often backfire, worsening affordability. Learn about supply-side solutions that can alleviate the housing crisis.

Introduction: The Challenge of Housing Affordability

Housing affordability has become a growing socio-economic challenge in the United States, affecting millions of households across urban, suburban, and even rural areas. Rising housing prices have far outpaced wage growth, leaving many families and individuals struggling to afford decent homes. This affordability gap is driven by a fundamental economic imbalance: demand for housing has consistently outstripped supply. While demand-side interventions, such as homebuyer tax credits have been implemented to ease this burden, they often fail to address the root cause of the issue—a chronic undersupply of housing units.

Without matching supply-side policies, specifically policies that stimulate housing construction, demand-side interventions will fail to improve affordability and will even exacerbate housing price inflation. The key to addressing housing affordability lies in increasing the housing stock through supply-side solutions.

The Economic Framework: Supply and Demand in the Housing Market

Understanding Supply and Demand

In economics, prices are determined by the interaction of supply and demand. The housing market follows the same principles: when more people are seeking homes (demand) than there are homes available (supply), prices rise. This leads to a scenario where many potential buyers or renters are priced out of the market, further fueling affordability concerns.

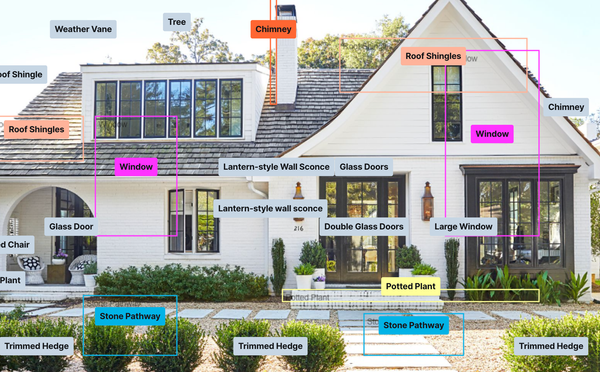

Figure 1: Increasing demand with fixed supply increases equilibrium prices

Characteristics Unique to Housing Supply

However, housing differs from other goods due to several unique characteristics that make the supply inelastic in the short term. These include:

- Long Construction Timelines: Building homes can take years, particularly when factoring in planning, financing, and construction.

- Geographic Constraints: Land is a finite resource, especially in high-demand urban areas. This scarcity further limits new housing developments.

- Regulatory Barriers: Zoning laws, building codes, and environmental reviews often delay or prevent new projects, reducing the ability of the market to respond to increased demand.

These factors combine to create a relatively inelastic housing supply, where supply doesn't rise in lockstep with demand, causing price volatility and long-term affordability problems.

Figure 2: The more inelastic the supply, the faster prices will go up given any increase in demand

The Pitfalls of Demand-Side Interventions

Shortcomings of Traditional Policies

Demand-side policies, such as homebuyer tax credits or subsidized mortgages, aim to enhance affordability by increasing consumers’ ability to pay for housing. While these policies can provide short-term relief, they often fall short of addressing the root issue: the lack of housing supply.

Figure 3: Demand-based policies will continue to lead to rising prices

All else equal when you give people more buying power overall prices will rise. Yes, these policies reduce the cost of purchasing homes in the short term, but without subseququent increases in housing supply, these policies lead to increased competition for existing units and overall house price inflation.

As these policies continue to fail, it is tempting to turn to alternative interventions such as price caps. In reality these policies completely ignore the reality of free market economies and how incentives influence behavior. It has been shown time and again that price caps such as rent control often create distortions in the market by discouraging investment and development in rental properties and ultimatley result in even worse housing shortages.

Figure 4: Price caps don't work either and lead to even worse housing shortages as they impact the incentive to offer housing.

Unintended Consequences

When demand increases without a corresponding increase in supply, it exacerbates the imbalance, driving prices even higher in the long run. Some of the unintended consequences of demand-side interventions include:

- Price Inflation: Even with enhanced purchasing power, a limited housing stock can push prices higher as more buyers compete for the same number of homes.

- Offsetting Gains: For instance, homebuyer subsidies might make houses temporarily more affordable, but they can lead to bidding wars that drive prices up, negating the initial affordability improvements.

Why Increasing Supply is Crucial

Supply Constraints and Affordability

The real obstacle to affordability lies in the constraints on housing supply. Several factors are responsible for this limitation:

- Zoning Restrictions: Local regulations often favor single-family homes over higher-density multi-family developments. This reduces the number of housing units that can be built on a given piece of land.

- Lengthy Approval Processes: Bureaucratic delays in granting building permits, approving zoning changes, and navigating environmental regulations slow down construction, leaving demand unaddressed.

Figure 5: Supply based policies such as reducing zoning restrictions can change the cost to produce new housing and shift supply (left chart) while reducing bureaucratic red tape can make supply more elastic (right chart). Both of which result in more housing units and overall lower prices.

Elasticity of Supply

In regions where the housing supply is more elastic (able to respond quickly to changes in demand), prices remain more stable. For example:

- Houston, Texas: Has maintained relatively stable home prices by minimizing zoning restrictions, allowing new developments to match the demand.

- San Francisco, California: Faces some of the highest housing costs in the nation due to restrictive zoning and lengthy approval processes, creating significant supply shortages.

Empirical studies have confirmed that housing markets with more restrictive regulations experience greater price volatility and higher long-term housing costs.

Debunking Myths Around Demand-Side Fixes

The Role of Corporate Investors

Public discourse frequently places blame on corporate ownership or real estate speculation for driving up housing prices. However, economic analysis reveals that corporate ownership plays a smaller role in overall affordability issues than many assume.

- Rational Investment: Corporate investors seek to maximize returns, often by focusing on areas of high demand. This reactive behavior does not inherently drive up prices but rather reflects existing demand trends.

- Supply Impact: Corporate investment can lead to the development of new housing units or the rehabilitation of older properties, both of which can contribute positively to the housing stock.

While speculation can sometimes inflate short-term prices, local supply constraints and zoning regulations are far more impactful on housing affordability in the long run.

Supply-Side Solutions: The Path Forward

Zoning Reform

One of the most effective ways to increase housing supply is through zoning reform. By allowing for higher-density housing developments, cities can add much-needed units to the market.

- Higher-Density Developments: Rezoning single-family areas to allow multi-family units can significantly increase the housing stock.

- Urban Infill: Encouraging development within existing urban infrastructure reduces sprawl and increases available units.

Examples of Successful Reform

The YIMBY (Yes In My Backyard) movement has gained traction in advocating for zoning changes that enable the construction of more diverse housing types. Cities adopting YIMBY principles have seen increases in new construction and more affordable housing prices.

Public-Private Partnerships and Incentives

Governments can work with private developers to increase housing supply through:

- Tax Incentives: Offering breaks to developers who build affordable housing.

- Public-Private Partnerships: Streamlining project approval processes in exchange for affordable housing commitments from developers.

By reducing regulatory barriers and incentivizing construction, policymakers can encourage the creation of more housing and, over time, ease the pressure on prices.

Conclusion: A Supply-Focused Path to Affordable Housing

In conclusion, addressing housing affordability requires more than just demand-side solutions. To create sustainable affordability, policymakers must focus on supply-side interventions. This includes zoning reform, reducing regulatory barriers, and incentivizing developers to build more homes. By expanding the supply of housing, market forces that drive up prices can be alleviated, benefiting current and future generations.

Expanding the housing supply is not just about economics—it’s about creating a future where housing is accessible and affordable for all.