Revisiting 2022: Is Now the Time to Reallocate to Real Assets?

With interest rates dropping, investors are reconsidering a shift from bonds to real assets like single-family rentals, which offer stability, income, and inflation protection in a changing market.

With interest rates starting to drop, we're revisiting a key analysis from 2022 on whether investors should shift bond portfolios toward real assets, particularly residential real estate. This research dives deep into the institutional investment trends within the single-family rental market. Interestingly, this analysis was never published at the time, as large-scale investors hit the brakes due to the Federal Reserve's aggressive quantitative tightening to curb inflation. As the market landscape evolves once again, the insights from this report are more relevant than ever.

Free Real Estate Research

Choose markets and investment strategies with confidence

Free Research ProductThe Shift from Bonds to Real Assets: Why Single-Family Rentals are Leading the Way

For years, bonds have been the go-to for investors seeking stable income and diversification. Long-term bonds provided low volatility and balanced equity risk. However, as bond market returns have diminished, investors are no longer compensated for the increased risks. This has sparked a search for new opportunities where capital can be reallocated to strategies that offer a more favorable balance of risk and reward.

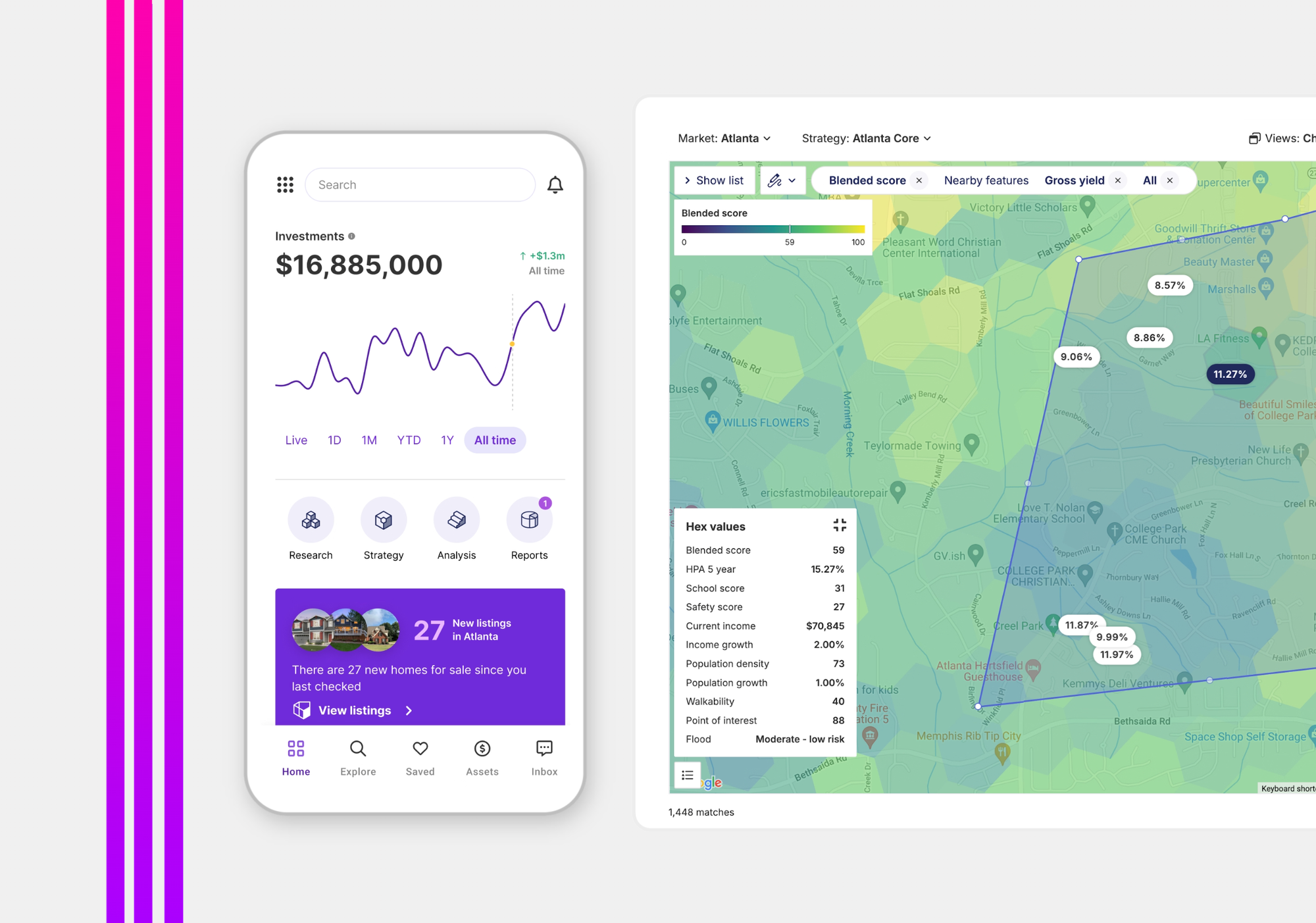

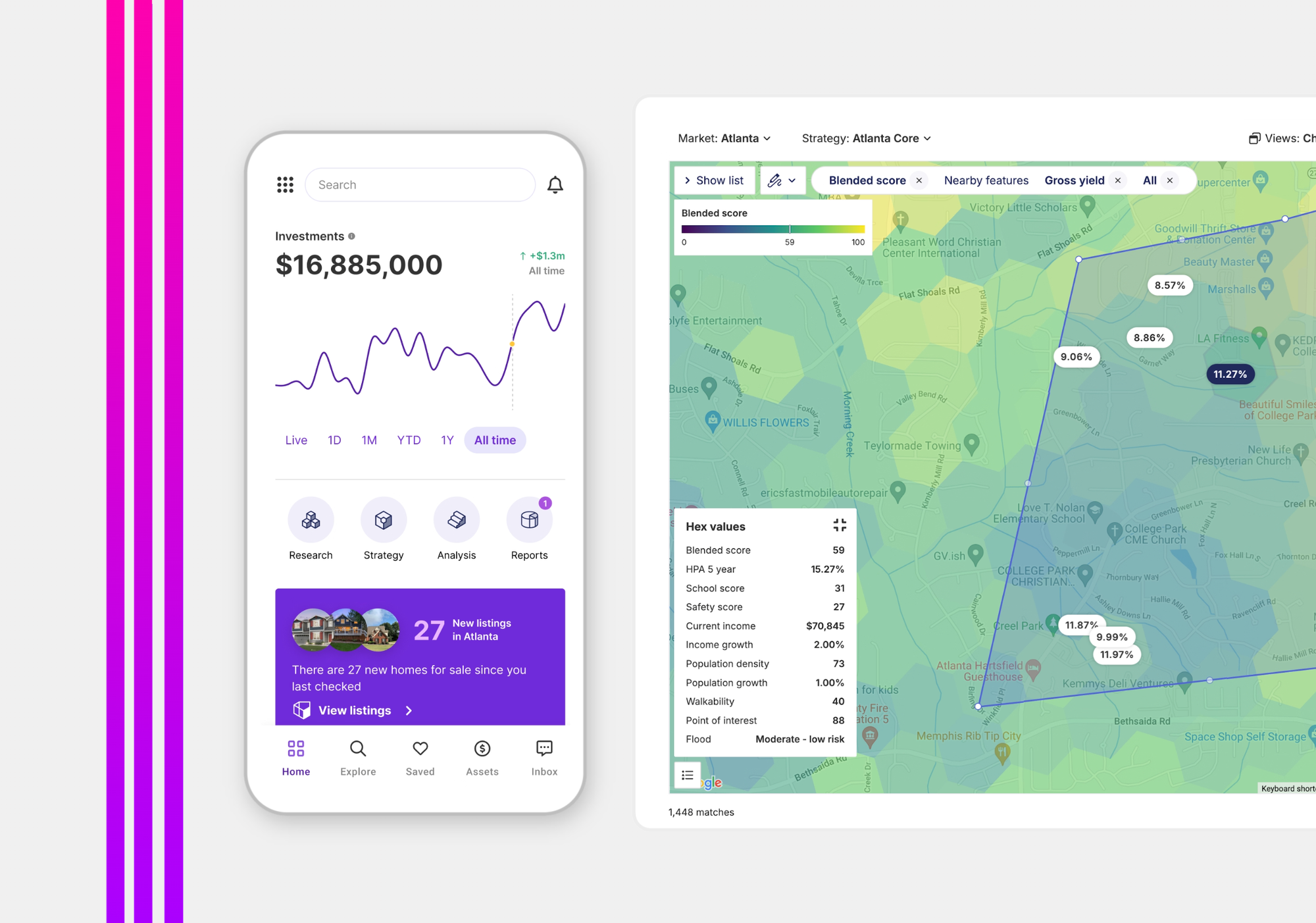

Real assets are emerging as a prime candidate due to their large market size and attractive returns. Among them, Single-Family Residential (SFR) real estate stands out as the largest asset class globally, valued at an impressive $162 trillion. Within this sector, Single-Family Rentals (SFR) are particularly compelling for bond investors, offering not only comparable stability but also several distinct advantages.

Despite the promising potential, institutional investors currently hold only a 2% market share in the U.S. SFR sector. This is largely due to outdated perceptions that SFRs are difficult to source and manage. However, the years following the Great Recession proved these assumptions wrong, as several operators successfully achieved scale and operational efficiency.

While only a few platforms today are capable of absorbing significant institutional inflows, the market is evolving quickly. Over the next five years, we expect a rise in platforms tailored to meet the growing demand from institutional investors—especially those looking to pivot away from traditional bond strategies and capitalize on the opportunities in SFR.

Open {pricing} API

Already have your own system? No problem. Try Picket's API instead.

Developer DocsUnderstanding Bond Returns: Risks and Strategies for Today's Investors

For decades, bonds have been the cornerstone of income strategies, offering low volatility, steady income, and essential equity diversification. Institutional portfolios typically include a mix of government, treasury, corporate, and securitized bonds, often mirroring the Bloomberg Barclays U.S. Aggregate Index.

Bonds provide income-producing assets with minimal correlation to equities, low beta, and solid returns—key factors for reducing macroeconomic exposure and building a diversified portfolio. While generally less risky than equities, bond investors still face several inherent risks:

- Interest Rate Risk

- Inflation Risk

- Credit/Default Risk

- Reinvestment Risk

- Liquidity Risk

Short-term bond investors experience greater volatility due to fluctuating interest rates and bond convexity. On the other hand, long-term investors face heightened inflation risk as duration increases. While long-term investors can mitigate interest rate risk by holding bonds to maturity, they encounter reinvestment risk due to the unpredictability of reinvestment timing. Short-term investors can better control this timing but are more exposed to liquidity risks.

To manage these risks, investors often deploy strategies combined with insurance products:

- Interest Rate Risk: Mitigate by holding bonds to maturity or investing in floating-rate products.

- Inflation Risk: Reduce exposure by purchasing inflation-protected products like TIPS.

- Credit/Default Risk: Diversify holdings and use insurance products such as Credit Default Swaps.

- Reinvestment Risk: Actively manage holdings and invest in products with yield maintenance to mitigate prepayment risks.

- Liquidity Risk: Focus on highly liquid, large markets or hold bonds to maturity.

Historically, investors have successfully preserved and grown capital through strategic combinations of these methods. However, reducing exposure to risks has become increasingly costly. For example, while TIPS protect against inflation, they often reduce real returns to zero, preserving capital but hindering growth.

As bond market conditions evolve, it's clear that while traditional strategies can manage risks, the balance between preservation and capital accumulation has become harder to achieve. Investors are increasingly looking to alternative assets to strike a better balance of risk and reward.

Research Done Right

Get real time research that is built on top of real transaction data, not surveys

Try ResearchThe Enduring Decline of Global Interest Rates: What It Means for Investors

For over 30 years, global real interest rates—both short- and long-term—have been on a steady downward trajectory, with rates remaining historically low since the 2008 financial crisis.

The Decline in Bond Yields Since the 1980s

Data from the St. Louis Fed shows a sustained decline in AAA, BAA, and 10-year Treasury yields over the long run. Traditional saving-investment dynamics explain part of this drop, as an aging population and a growing aversion to risk put downward pressure on credit markets. However, broader factors such as shifting global monetary policies and increased economic stimulus from central banks worldwide have amplified this trend.

Yet, the decline in returns on debt isn’t just a recent phenomenon—it’s been happening for centuries. A broader historical context shows that interest rates have been falling steadily for over 700 years. This long-term trend suggests that the current low-rate environment is part of the natural evolution of increasingly sophisticated, globalized credit markets powered by technology.

A Global Perspective: Rates Continue to Fall

Wonderful chart credit goes to visual capitalist

Regardless of the theory behind it, the data is clear—real interest rates are declining. It's becoming more unlikely that central banks will reverse this trend anytime soon. In fact, U.S. rates may continue to fall, as they remain relatively high compared to other developed nations.

Ten-year government treasuries around the world are at historically low levels, with some even offering negative interest rates. Remarkably, 25% of global bonds are currently trading at negative yields. While U.S. investors are fortunate to avoid negative rates for now, the situation is far more challenging in markets like Japan and Germany, where 10-year and even 30-year bonds are offering little to no return.

The Changing Risk-Reward Profile of Bonds

Since the 2008 financial crisis, bond investors have seen a troubling divergence between modified duration and yield-to-worst. This means that despite taking on more risk, investors are being compensated less.

For institutional investors focused on capital preservation, accumulation, and low equity correlation, this low-rate environment presents serious challenges. Only high-risk strategies seem capable of delivering meaningful capital growth—but these strategies also bring increased volatility, which undermines wealth preservation and raises equity correlation.

Duration and Yield-to-Worst Over Time: Bloomberg Barclays U.S Aggregate

Exploring Alternatives to Bonds

In today’s market, the case for bonds is becoming harder to justify, even for yield-driven investors. With capital preservation at risk and alternative asset classes offering more attractive opportunities, institutional investors are beginning to explore new avenues.

Invest at Scale

Picket delivers simple, powerful, and beautiful products to help you invest in residential real estate at scale and across markets.

See for YourselfBond Allocation Alternatives

Historically, a handful of key bond attributes provided an immense benefit to institutional portfolios.

- Capital preservation (minimal downside) - Bonds held to maturity can only go to zero in the event of a default, which can be modeled and predicted (not always accurately as evidenced by the cascade of defaults during the 2008 financial crisis).

- Low volatility - Long-dated investors have a known, and capped investment upside and little exposure to near term bond price volatility.

- Capital Accumulation / Income - Unlike equities, bonds produce predictable income. However that income is taxed as ordinary income, not capital gains.

- Hedge against economic volatility - While not necessarily a hedge against volatility, bond income is less impacted by macroeconomic events. The main correlation that still exists is credit risk. The lower rated a bond is, the more impactful this correlation becomes. So while AAA bonds show little correlation to a recession, junk bonds are significantly more correlated.

- Ability to absorb large allocations of capital - The bond market is large and highly liquid which allows investors to minimize undeployed capital, which is a drag on portfolio returns in inflationary environments.

In today’s bond markets, investors optimizing for risk-adjusted returns have limited options. While balancing the tradeoffs between current income and total return, bonds do still have scale, but increasingly fail to offer the entire basket of attractive attributes. Alternative strategies that more effectively offer the desired attributes that bonds used to offer should warrant serious consideration from institutional investors and attract meaningful reallocations from the $100T+ global bond market.

Yield-driven, blue chip equities offer some of desired attributes, but most institutional investors already have significant equity exposure which reduces diversification makes portfolios more vulnerable to macroeconomic movements. In addition, the non-fungible and ever changing nature of equities requires investors take on a active, hands on approach, or alternatively invest through actively managed funds. However, it is highly unrealistic given the basket of desired attributes that equities offer the best solution for reallocation. Alternatively, real assets provide a more attractive opportunity and are large enough to absorb significant capital for the foreseeable future.

Open {pricing} API

Already have your own system? No problem. Try Picket's API instead.

Developer DocsExploring Alternatives to Bond Allocations: Real Assets as a Rising Opportunity

Historically, bonds have played a critical role in institutional portfolios due to several key attributes:

- Capital Preservation: Bonds held to maturity carry minimal downside risk, with the main threat being default, which can be modeled—though not always accurately, as seen during the 2008 financial crisis.

- Low Volatility: Long-term bond investors enjoy a capped upside and minimal exposure to short-term price volatility.

- Capital Accumulation/Income: Bonds provide predictable income streams, though this income is taxed as ordinary income, not as capital gains.

- Hedge Against Economic Volatility: While not a direct hedge against all volatility, bond income remains relatively insulated from macroeconomic events, with credit risk being the primary factor to watch. AAA bonds, for example, show low correlation to recessions, while junk bonds are much more vulnerable.

- Absorption of Large Capital Allocations: The bond market’s size and liquidity enable investors to deploy significant capital efficiently, reducing the drag of undeployed funds, especially in inflationary environments.

However, in today’s evolving bond market, institutional investors seeking to optimize risk-adjusted returns face increasingly limited options. While bonds still offer scale, they no longer provide the full basket of benefits they once did. This reality pushes investors to consider alternatives that more effectively meet their portfolio needs.

The Search for Alternatives

Some yield-driven, blue-chip equities offer a partial solution, sharing a few of the desired attributes. However, most institutional portfolios already have substantial equity exposure, which reduces diversification and increases vulnerability to market fluctuations. Equities also require an active, hands-on approach or reliance on actively managed funds, making them less ideal for those seeking stable, passive returns.

A more compelling alternative is real assets. Real assets not only provide the desirable characteristics that bonds once offered—such as capital preservation, income generation, and resilience against volatility—but also have the scale to absorb significant institutional capital over the long term. Unlike equities, real assets offer a tangible, less volatile investment opportunity and are increasingly attracting institutional attention.

Why Real Assets?

With more than $100 trillion currently allocated to the global bond market, the shift toward real assets is not just a trend—it’s becoming a necessity. As investors face the limitations of traditional bonds and the complexities of equity markets, real assets present a scalable, attractive alternative for those seeking both stability and growth in a low-rate, high-risk world.

The Open Real Estate Company

Picket is on a mission to make real estate open, efficient, and fun for all

See How It's GoingSingle-Family Residential (SFR) & Rentals: An Underutilized Opportunity for Institutional Investors

.Despite its massive size and attractive fundamentals, the Single-Family Residential (SFR) market remains severely underrepresented by institutional investors. Currently, institutional ownership accounts for only 2% of the $4 trillion SFR rental market, with the majority of assets managed by individual, local operators who typically control just 1 to 3 properties.

The Largest Real Estate Asset Class

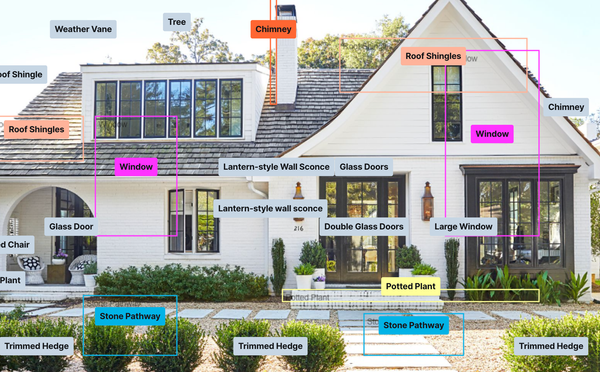

SFR is the largest single asset class in real estate, valued at roughly $33 trillion in the U.S. alone. Its fundamentals make it one of the most appealing real estate sectors. However, institutional investors have historically faced barriers to entering the market due to high sourcing costs and the perceived complexity of managing large portfolios.

- Largest Category of Investor-Owned Real Estate: With over $4 trillion in assets, SFR already ranks as the largest category of investor-owned real estate, despite institutional participation remaining below 2% and overall investor penetration just over 10%.

- Fragmented, Liquid Asset Base: The U.S. median home value is just under $250K, with approximately 5 million homes bought and sold annually. This fragmented yet liquid market presents ample opportunities for investors to scale.

- Supply Constraints Support Asset Values: The low-density nature of SFR makes it difficult to add new supply, especially in high-demand areas with limited land. This supply-demand imbalance bolsters rental prices and asset appreciation over time.

Superpowers for Real Estate

See how Picket helps real estate investors leverage the power of AI

View ProductOvercoming Operational Challenges

Since the 2008 financial crisis, several institutional investors have demonstrated the ability to navigate the challenges once associated with the SFR space. Initially, operational difficulties, such as managing properties and increasing net operating income (NOI), were valid concerns. Many early operators struggled with third-party managers, leading to lower-than-expected returns.

However, as operators brought management in-house, NOIs surged, reaching over 60% in some cases and even surpassing 65%. This improvement in margins has made the ownership and operation of SFR at scale not only feasible but highly profitable. As a result, institutional capital formation around SFR has been rapidly accelerating.

Major Players Leading the Way

A handful of key players have already emerged as leaders in institutional SFR investment, including:

Invitation Homes: The largest public REIT in the space, with a portfolio of 85,000 homes.

American Homes for Rent: Another major public REIT, managing 65,000 homes.

Progress Residential: A private operator with a growing portfolio of 45,000 homes.

With risks now mitigated and operational efficiencies realized, institutional investors are beginning to recognize the long-term value of SFR. As capital continues to flow into this sector, it is poised to become an increasingly dominant force in the real estate investment landscape.

Try Picket for Free

Our product, data, and services marketplace make investing in real estate a easy at any scale.

Get StartedThe Advantages of Single-Family Rentals (SFR) Over Bonds

Single-Family Rentals (SFR) share several attractive characteristics with other real estate and real asset investments, but offer unique advantages that make them particularly compelling when compared to bonds.

Key Advantages of SFR:

- Attractive Total Returns

- Low Vacancy Rates

- Growing Demand

- Impressive Stability

- Diversification

- Strong Income

- Inflation Hedge

- Tax Efficiency

- Huge Investable Market

- Highly Liquid Asset

Attractive Total Returns

SFR stands out as one of the most compelling risk-reward opportunities for institutional investors, thanks to its strong fundamentals and low institutional penetration. Unlike other investments offering inflation protection, low volatility, and uncorrelated returns, SFR portfolios also provide capital appreciation. On average, SFR portfolios generate internal rates of return (IRRs) in excess of 10%, and they pay an annual dividend of more than 7% over a 10-year holding period.

For comparison, Moody’s Seasoned Baa Corporate Bonds currently yield less than 4%*, which is significantly lower than the yield from SFR alone. Additionally, unlike bonds held to maturity with fixed returns, SFR returns fluctuate based on various macro and microeconomic factors, offering potential for higher growth.

Drivers of Total Return

The primary factors driving total returns in SFR portfolios include:

Gross Yield: The income generated relative to the property’s value.

Home Price Appreciation (HPA): As home values increase over time, SFR investors benefit from capital gains.

Net Operating Income (NOI) Margin: Effective management of operating costs drives higher profitability.

Inflation: SFR provides a natural hedge against inflation, as rents tend to rise in tandem with inflation, preserving purchasing power and boosting returns.

The Open Real Estate company

Picket is on a mission to make real estate open, efficient, and fun for all

See How It's GoingStability, Income, and Growth

SFR offers impressive stability with low vacancy rates and growing demand, particularly in areas with strong population growth and limited housing supply. This results in reliable rental income and potential for long-term appreciation. Additionally, the tax advantages associated with real estate—such as depreciation deductions—further enhance net returns, making SFR more tax-efficient than bonds, which are typically taxed at ordinary income rates.

With a large, highly liquid market and strong income potential, SFR has become an increasingly attractive alternative for institutional investors seeking higher returns, stability, and inflation protection without the limitations of traditional bond portfolios.

Figure 10: Impact of NOI and HPA on total returns

Home Price Appreciation (HPA): A Key Factor in SFR Returns

Over the long run, national home price appreciation (HPA) in the United States averages around 3.7% annually. Historically, there’s been a strong correlation between a market’s price appreciation and the net yields that current rents support. This relationship aligns with the rational market hypothesis, where asset prices across markets adjust to reflect similar expectations of future returns.

The Correlation Between Net Yield and Price Appreciation

Generally, markets with high net yields signal expectations of lower future price appreciation, while markets with lower net yields indicate higher expected future price appreciation. This correlation has been a reliable indicator of past price trends, but it’s not always predictive of future HPA. Markets can shift in or out of favor over an investment’s lifecycle, affecting projected returns. For institutional investors, a poorly timed market decision can reduce IRR by 100-200 basis points.

However, even in worst-case scenarios, the SFR asset class tends to outperform bond markets in terms of returns. Strong HPA only makes the investment case more compelling. Investors can use widely available data to identify markets that offer the most attractive combination of current income and future price appreciation. Markets where current gross yields do not adequately reflect future HPA present opportunities for outsized returns.

HPA Performance: 1980-2000 vs. 2000-2020

As shown in historical data, the relationship between net yields and HPA performance varies by market over time. For example:

Top Left Quadrant: Markets that appeared attractive from 1980-2000 but underperformed from 2000-2020.

Bottom Right Quadrant: Markets that seemed less attractive from 1980-2000 but have since rolled into favor, delivering stronger HPA from 2000-2020.

Top Right and Bottom Left Quadrants: Markets that consistently performed in line with expectations.

Investors who can identify mispricings in net yields across these markets have the potential to capture above-average returns.

Forecasting Future HPA: Key Factors

Rather than relying solely on net yields, institutional investors should focus on more causal factors that better predict future HPA. At a high level, home values are shaped by supply and demand dynamics. The highest appreciation markets typically have:

- Low Supply Elasticity: Limited ability to add new housing stock.

- Strong Demand Drivers: Robust job growth, rising wages, and population growth (e.g., Sun Belt markets).

In contrast, markets with lower appreciation often face:

- High Supply Elasticity: Easy to add housing supply.

- Weak Demand Drivers: Shrinking populations or stagnant economies (e.g., Rust Belt markets).

In addition to market-level factors, submarkets can appreciate at different rates. Although submarket movements are influenced by complex socio-economic factors, and predictions beyond a few years can be difficult, investors can mitigate risk by diversifying geographically across both markets and submarkets. When properly diversified, HPA becomes highly predictable with low deviation from the expected mean, making it a highly attractive factor for long-term institutional investors.

Gross Yield: A Key Metric for Institutional Investors

Gross yield, which represents the annual market rent for a property divided by its total acquisition cost, is closely correlated with expected home price appreciation (HPA). Institutional investors seeking higher income often target markets with high gross yields, which typically come with lower expected price appreciation.

One of the most attractive aspects of gross yields is the stability of rental income. Rent prices tend to remain remarkably stable, even in volatile markets, generally tracking core inflation with adjustments based on local income growth. This makes gross yield an essential factor for investors focused on generating consistent, predictable returns, regardless of broader market fluctuations.

Net Operating Income (NOI) Margin: The Impact of Operational Efficiency

In the early days of the Single-Family Rental (SFR) market, operators often struggled with inefficiencies, but today’s large-scale operators typically achieve Net Operating Income (NOI) margins above 60%, with top performers approaching 70%. As illustrated in Figure 10, the difference in returns between an efficient and inefficient operator is significant, directly affecting the returns for institutional investors.

Selecting the right operator is critical for maximizing returns. Institutional investors should prioritize sophisticated operators that leverage technology and have a proven track record in the SFR space. By partnering with well-run operators, investors can ensure higher NOI margins, which translate into stronger overall performance and more reliable returns.

Inflation: A Built-In Hedge for Single-Family Rentals (SFR)

Over the long run, both operating costs and revenues in the Single-Family Rental (SFR) market tend to rise in line with inflation (see the section on SFR Stability & Inflation Protection). While inflation primarily impacts nominal returns, the inflation-protected nature of SFR ensures that real returns remain stable, regardless of inflation levels.

Although SFR may be perceived as volatile, this volatility is asymmetrically skewed to the positive. In other words, even the lower end of return deviations remains attractive on a risk-adjusted basis, offering far more upside potential than what institutional investors can expect from fixed-income markets. This makes SFR a powerful inflation hedge, providing both stability and the opportunity for outsized returns, even in inflationary environments.

Figure 11: Impact of short term price fluctuations and market timing on total returns

Low Vacancy Rates: A Strong Indicator of Consumer Demand

Vacancy rates in the Single-Family Rental (SFR) market are comparable to those seen in highly attractive industrial assets and remain near the bottom range across all institutional asset types. Despite the market's large size, these low vacancy rates—significantly lower than in the multi-family sector—demonstrate strong and growing consumer demand for single-family rentals. This consistent demand provides stability and predictability for institutional investors, making SFR an increasingly attractive investment opportunity.

Growing Demand: A Strong Future for the Single-Family Rental Market

The Single-Family Rental (SFR) market is already substantial, but current socio-economic trends indicate that demand will continue to grow both in the near and long term. Factors such as shifting demographics, increased housing affordability challenges, and changing lifestyle preferences are driving more individuals toward renting single-family homes. This sustained and growing demand enhances the long-term stability and attractiveness of SFR as an investment for institutional portfolios.

Here’s a compelling conclusion to wrap up your blog post:

Conclusion: The Case for Single-Family Rentals in Institutional Portfolios

As institutional investors seek to navigate an increasingly complex and low-yield environment, the Single-Family Rental (SFR) market emerges as a powerful alternative to traditional bond investments. With compelling attributes such as stable gross yields, strong demand, low vacancy rates, and the ability to hedge against inflation, SFR offers a unique opportunity to capture both income and long-term appreciation.

Unlike fixed-income assets, which face diminishing returns in today’s market, SFR portfolios benefit from real asset appreciation, consistent rental income, and diversification across different submarkets. Furthermore, institutional investors can leverage operational efficiencies and select top-tier operators to maximize net operating income (NOI) margins, further enhancing returns.

In the face of global economic uncertainty and evolving investor needs, the SFR market provides not only a stable investment vehicle but also significant upside potential. By strategically allocating capital to this underrepresented asset class, institutional investors can diversify their portfolios, generate inflation-protected income, and achieve attractive risk-adjusted returns that far exceed the limitations of traditional bond markets.

In summary, the SFR market represents a compelling opportunity for long-term growth, stability, and income generation, making it a critical consideration for institutional investors looking to balance risk and reward in the modern investment landscape.

"If I had a way of buying a couple hundred thousand single-family homes, I would load up on them. It's a very attractive asset class now. I could buy them at distressed prices, and find a way to manage them—the management is enormous and really the problem because it's really difficult—but I would do it." - Warren Buffet, CNBC interview 2012

The Open Real Estate Company

Picket is on a mission to make real estate open, efficient, and fun for all

See How It's Going