Top Software for Real Estate Investors in 2024: The Ultimate Guide

Explore the best software tools for real estate investors in 2024, covering research, property analysis, buying, selling, and investment management. Learn how these tools can streamline your workflow and maximize returns on your investments.

In today’s fast-paced and competitive real estate market, having the right tools is critical for success—whether you’re an individual investor or managing institutional assets. The right software can make all the difference, helping you streamline every step of the process, from research and data analysis to buying, selling, and property management.

In this guide, we’ll explore the five essential types of software that every real estate investor should be familiar with: Research & Data, Property Analysis, Buying, Selling, and Investment Management. Whether you're just starting or scaling up, these tools are designed to optimize your workflow and maximize your returns.

Research: Self-Service vs. Managed Research Services

The foundation of any successful real estate investment begins with thorough research and data analysis. Choosing the right research tool is critical—it enables investors to assess market trends, evaluate risks, and identify high-potential markets and submarkets.

While John Burns Real Estate Consulting continues to dominate the market, particularly among institutional investors, a growing number of affordable, self-service research products are gaining popularity for their accessibility and flexibility.

- Top Institutional Product: John Burns Real Estate Consulting

- Top Free Product: Redfin Research

One downside of John Burns’ research is that it tends to rely on top-down, survey-driven data, which may not always capture the nuanced, granular insights that bottom-up aggregates can provide. The Picket research team recently explored why top-down strategies often fall short of expectations. In the article below, they highlight key reasons for these shortcomings and discuss how bottom-up approaches can better serve investors.

Picket for Research

Choose markets with confidence with Picket's self service data platform

Try ResearchAnalysis: Finding the Best Solution for Property Underwriting

After identifying potential investments, the next step is to analyze the numbers. Property analysis software allows investors to assess a deal’s viability by providing key data points such as property value, cash flow projections, ROI, and more.

- Best for New Investors: BiggerPockets

- Best Free Software: Spreadsheet

- Best Managed Service: Roofstock

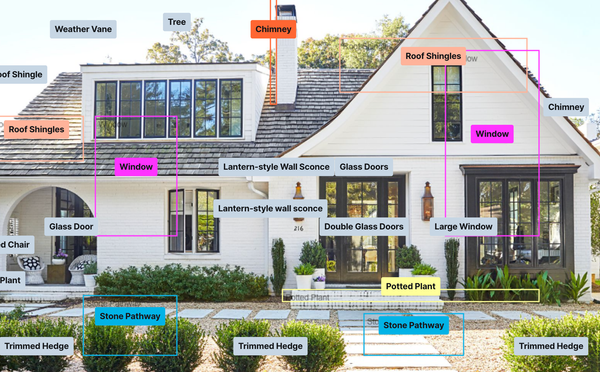

When selecting property analysis software, here are the critical components all investors need to ensure the tool works effectively:

- Local, reliable rental & sale comp data

- Accurate rent AVMs (Automated Valuation Models)

- Reliable expense estimates for HOA fees, taxes, insurance, property management, and maintenance

Advanced features, which may not be available in every system but could significantly influence your choice, include:

- Growth forecasts for rent and home prices

- Property-specific renovation estimates based on photos

- Custom and automated analysis tools

- Support for multiple investment strategies

- Off-market property analysis

- Portfolio analysis

- Build-to-rent analysis

- Collaboration features like notes, messaging, and notifications

- Dynamic real estate custom analysis capabilities

To learn more about how Picket is using artificial intelligence to enhance and automate property analytics, check out the articles below.

Picket for Property Analysis

Picket is both free and has more advanced features than any other products

Analyze a PropertyChoosing the Right Real Estate CRM to Manage Offers and Transactions

Navigating multiple real estate transactions at once can feel overwhelming, especially without the right tools. A reliable real estate CRM simplifies the entire process, from property acquisition to closing, keeping you organized and on track.

- Best for Agents: Follow Up Boss

- Best Small Investors: Resisimpli

- Best for Large Investors: Salesforce

While there are numerous CRM solutions designed for real estate agents, investor-focused tools remain limited. This makes sense for small-scale investors, as many end up managing the process via email or using the agent's software, often with a buyer-specific transaction view.

For high-volume acquisitions, there are really two main options:

- Build your own solution using a flexible CRM like Salesforce

- Adopt an investment-focused platform like Picket, which helps investors buy at scale

Before deciding on a custom-built solution, it's important to consider both the upfront development costs and the ongoing maintenance expenses. One common complaint from companies that build custom Salesforce solutions is the high cost of maintaining them and the sluggish pace of adapting to evolving business needs.

Picket for Buying

See how Picket's CRM makes it efficient, easy, and fun to grow your portfolio

Try it FreeFinding the Right Software to Manage Renovations, Listings, and Transactions

When it's time to sell a property, maximizing its value is your top priority. Selling software helps streamline everything from listing properties to automating marketing efforts, making it easier to reach potential buyers efficiently.

- Best For Small Investors: Stick with your Sales Agents' system of choice

- Best For Scaling: Custom Salesforce app

Investor-focused selling software has historically been limited, as there wasn’t enough demand to justify the development of dedicated solutions. For most investors who aren’t selling frequently or in high volumes, investing in specific sales software should be low on the priority list.

If you're selling at higher volumes, your best options are to either customize a workflow in Salesforce, Airtable, or a similar CRM/workflow builder. Alternatively, you can explore newly released platforms like Picket, which includes sales management as part of a full life-cycle solution.

Renovate to Sell for More

Use Picket's AI powered calculator to maximize sales profits

Plan RenovationBy using a full-stack solution like Picket, you gain access to investor-focused features such as a renovation calculator, which helps you determine the optimal amount to spend on repairs before listing. This ensures you maximize sales proceeds and investment profitability.

Investment Management: Choosing the Right Platform for Your Portfolio

Managing a growing portfolio of real estate properties requires a comprehensive investment management platform. These tools help track performance, forecast future returns, and ensure that your investments are aligned with your long-term financial goals.

- Best for small investors: Spreadsheets

- Best for large investors: Custom Salesforce app

While many property managers offer an owner portal as part of their management system, these portals often fall short when it comes to robust investment management. There are third-party systems available that offer more advanced investment management features, but for small investors, it’s typically not worth the effort to input and organize all the data in these systems. If you own fewer than 20 properties, spreadsheets and organized computer folders are usually sufficient.

However, as your portfolio grows, you’ll likely need to either hire additional help or invest in a more tailored solution. For larger investors, particularly those with more complex reporting and accounting needs, the best option is often a custom-built system using Salesforce or similar tools. In fact, nearly every large institutional investor we’ve spoken to has implemented such a system.

Picket for Managing

See how Picket's AI powered investment tools help you stay organized, manage vendors, and control your investment data.

Add Your InvestmentsIn Conclusion

Investing in real estate is no longer just about buying and selling properties—it’s about using the right technology to make smarter, faster, and more profitable decisions. Whether you're a newcomer or a seasoned investor, the software solutions outlined in this guide are essential to staying competitive in today’s market.

At Picket, we are committed to building an open real estate platform. With open APIs, we empower large companies to integrate our technology seamlessly into their existing systems. Additionally, we offer free tools designed for investors of all sizes, making real estate more accessible, efficient, and enjoyable for everyone.

If you already have established systems, we encourage you to explore Picket Web Services, our suite of open APIs. For smaller investors or those just starting out, we highly recommend trying our free, full-lifecycle product before deciding on more advanced, paid solutions.

Picket Is the OPEN Real Estate Company

Picket is on a mission to make real estate open, efficient, and fun for all

See the Platform